Beer by the Numbers with Bart Watson, is part 2 of 2 articles featuring a Profiles in Craft Beer interview with Bart Watson. Part 1 provides insight into Bart’s background and the type of work he does. If you haven’t yet read part 1, do so by clicking here. Part 2 focuses on some of Bart’s recent research and findings that are important to small and independent craft brewers.

As the Chief Economist for the Brewers Association, a not-for-profit trade organization that protects and promotes small and independent U.S. brewers, Bart Watson, PhD, is in charge of the Brewers Association’s statistical resources, including production surveys, economic analysis, and market research. In addition to providing industry data for members, his responsibilities include interacting with the media on economic and statistical issues.

As of 2019, small and independent U.S. craft beer was an $80B dollar industry in terms of economic impact. In addition, the industry contributed more than half a million jobs to the U.S. economy directly and indirectly.

Bart Watson discusses beer by the numbers at the California Craft Beer Summit in 2019

Bart Watson discusses beer by the numbers at the California Craft Beer Summit in 2019

Gathering the Status of Craft Beer by the Numbers

Bart and I discussed some of his recent beer by the numbers research and findings that are important to small and independent craft brewers including the impact of COVID-19, craft beer influence to tourism, and diversity in craft beer.

COVID-19 Strikes

COVID-19 changed the 2020 craft beer market in ways that are still manifesting themselves. The COVID-19 pandemic greatly impacted breweries throughout the world and continues to do so. The majority of the more than 8,000 breweries in the United States are small and independent. The business of these breweries has been hit hard.

COVID-19 changed the 2020 craft beer market in ways that are still manifesting themselves. The COVID-19 pandemic greatly impacted breweries throughout the world and continues to do so. The majority of the more than 8,000 breweries in the United States are small and independent. The business of these breweries has been hit hard.

Tap room sales are historically responsible for the majority of income for small craft breweries. But almost everywhere, taprooms for these smaller breweries were initially shuttered or limited to window sales to-go.

Initial Impact Survey

In fact, an initial impact survey conducted by the Brewers Association in late March, with 938 U.S. small and independent craft breweries responding, showed more than 90 percent of respondents saw a major decline in onsite sales. And at the time, 87 percent had closed their taprooms or brewpubs. The result included drastic employee furloughs and layoffs.

Bart explained, “The 1st survey addressed ‘what is going on right now as this begins’…. So we asked questions like: ‘Have you shut down your tap room or brewpub?’ and ‘Are you considering laying-off workers?’. This was a very early forward look to understand how breweries thought this pandemic was going to hit their business and what they had already done in those early weeks to react. And I think what we saw was that breweries were taking it very seriously. Many were already planning to lay off workers even before the government mandated shut-downs. They were anticipating some of the extreme challenges that were to come.”

Second Survey

The Brewers Association conducted a second impact poll in early April. Of the more than 500 breweries that responded to that poll, 46% indicated that they didn’t think they could survive for 1-3 months. In short, the information suggested that thousands of small craft breweries were at risk of closing.

Bart elaborated, “The 2nd survey tried (once things had really hit) to quantify the impact to breweries and the depth of the economic challenges. So when we saw demand and consumer spending fall off a cliff, that’s when we did that 2nd survey. And what we saw was breweries had a pretty negative sense of the situation – which makes sense given how rapidly things were deteriorating. They also had a really good sense of the impact by channel. So, their draft distribution was hit hardest, at the brewery sales hit second hardest and if they were lucky enough to be doing packaging then they were doing better. And subsequent to then we’ve seen a lot more data to bear that out. I think that survey was a good, accurate look at some of those kind of sales by channel.”

Third Survey

However, craft breweries adapted. In late May, the Brewers Association published the results of their third impact assessment survey. The data showed improved optimism but challenges remained. Moreover, any recovery results were tepid.

Said Bart, “Some of the doom and gloom we saw from breweries (in the second survey) about their ability to continue operating didn’t play out in the coming weeks. So the 3rd survey was very much a reaction to that and was motivated by a desire to understand why breweries hadn’t closed in great numbers, to understand what they were doing to pivot their business models and what (in terms of either policies, sales, changes in the economy and consumer behavior) had made them more positive….From the survey we discovered brewers had pivoted pretty significantly in their business models to delivery. They went from single digit to almost 40% of breweries doing delivery. To go percentages went up as well. And a slight number of breweries increased their direct to consumer sales.”

In a recent article titled 2020 Midyear Craft Beer Trends, Bart Watson wrote: “…some consumers adjusted and started feeling more comfortable reentering the world, bringing a slow return to sales, with high levels of variation by place and demographics. This return largely took place the second half of May and throughout June…. Data from BeerBoard showed only 16% of locations open and pouring beer May 8-10, a number that had risen to 84% by June 19-21.”

A Fourth Phase?

Off-premise beer sales have continued to grow amid the coronavirus pandemic, as the majority of American drinkers remain unable or unwilling to consume alcohol on-site at bars and restaurants due to forced closures, capacity restrictions or just consumer reluctance. A recent article by Forbes Magazine notes that off-premise beer sales accelerated over the four-week period ending May 17, growing 13% compared to the preceding four-week period between mid-March and mid-April. In addition, year-to-date off-premise beer sales are up 12.8%, driven by the continued growth of flavored malt beverages (FMBs), import offerings and craft beer.

But as COVID-19 cases have once again spiked, the economy and craft beer may be entering a fourth phase that could result in turbulent economic impacts. Bart wrote: “To truly recover, we need to solve (or at least contain) the public health issues, restore consumer confidence in reentering social life, not to mention repair the gaps in demand resulting from laid off workers and shuttered businesses. Solving all three of these pieces seems unlikely in the short term.”

Seeking Further Help

I asked Bart about what further steps the federal and state governments could take to assist small and independent craft brewers. He pointed to two main courses of action:

- Allowing breweries greater flexibility with to-go and delivery sales

“Providing greater flexibility in allowing businesses to meet the demand for their beers just makes good sense – from both a business side and a public health and wellness side. If people want to buy local beer but don’t want to expose themselves to any risk by going into a brewery then allow greater flexibility with to-go and delivery. Either extend or make permanent those rules. I think that’s the biggest one.”

- Extending and improving PPP loans and other specific government support

“I think it’s easy to confuse the trend of things improving with growth. Most of our members’ sales are still down sharply. A key thing we’ve seen from the survey is that small businesses are not out of the woods yet. Just because states are reopening, it doesn’t mean it’s time to take our foot off the economic policy gas…. From an economic or a policy perspective, spending a little money to keep continuity of business active now is way better than the amount money society is going to have to spend if we don’t want to see a whole bunch of breweries or restaurants close and then have to fill them back in with new ones.”

Some key areas that breweries indicate would be especially helpful in government support include (1) more direct grants for breweries and other hospitality businesses; (2) permanent excise tax re-calibration (make current rates permanent); (3) spoiled beer tax credit; and (4) excise tax payment delays.

Craft Beer Tourism

![]() Clearly, tourism in general has suffered greatly due to the COVID-19 pandemic. For tourism to flourish again, consumer travel safety confidence must be restored.

Clearly, tourism in general has suffered greatly due to the COVID-19 pandemic. For tourism to flourish again, consumer travel safety confidence must be restored.

However, once travel starts again could craft beer help rekindle tourism growth? One way to assess an answer to that question involves looking at the past. Bart Watson and others have looked at some aspects of craft beer’s past impact to tourism.

Bart commented, “First thing I would say is the cause and effect are hard to determine here. So you want to be careful not to say craft breweries are the reason that people come (tourism) although there is some growing evidence of that. What we see generally is that 50-60 million people now say they visit a brewery that is more than 2 hours from their home every year. And many of those people are clearly traveling specifically for the small breweries and to visit those. So craft brewery tourism is growing. It’s already large. And it is something that can bring new dollars into a community on a day-to-day basis or on a special occasion.”

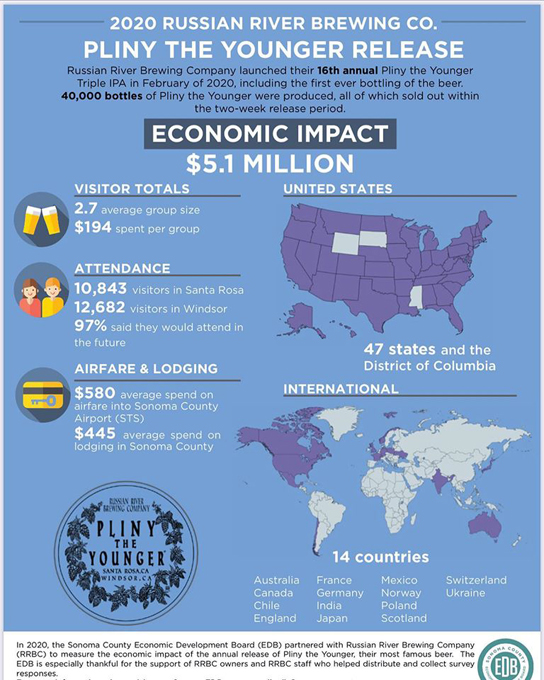

As an example, each year Russian River Brewing Company, in Sonoma County, CA, releases a limited-availability beer called Pliny the Younger. The craft beer release provides a tremendous boost to Sonoma County’s economy. So much so that the county conducts an annual analysis to determine the impact. The Sonoma County Economic Development Board released their annual Pliny the Younger Impact Assessment Report for 2020. The February 2020 release of Pliny the Younger resulted in a $5.1M insertion of tourism dollars to the county!

Pliny the Younger Impact Assessment Report for 2020 – Beer by the Numbers in Action

Pliny the Younger Impact Assessment Report for 2020 – Beer by the Numbers in Action

Bart said, “It’s obviously a unique event but you can see little versions of that all across the country with little breweries that bring people in and give them another reason to travel to that place.”

Bart added, “One other thing is that … the brewery growth has been in smaller towns. Larger towns are often higher cost environments so obviously they have a lot of people and they have a lot of breweries. But on a per capita basis there are actually more breweries in smaller towns than there are larger metro areas. And that plays a role in economic development.”

Diversity as Measured in Craft Beer by the Numbers

![]() In 2019, the Brewers Association released its first report on brewery employee diversity. The survey results were not surprising, finding the majority of people who own or work in breweries are white men.

In 2019, the Brewers Association released its first report on brewery employee diversity. The survey results were not surprising, finding the majority of people who own or work in breweries are white men.

Here are just a few of the numbers from the 2019 survey:

- Brewery Owner Ethnicity

- White – 88%

- American Indian or Alaska Native – 4%

- Asian – 2%

- Hispanic – 2%

- Black – 1%

- Other – 3%

- Brewery Owner Gender

- One Gender – 54%

- 50-50 Gender Ownership – 31%

- Other Mixed Gender Split – 15%

- Female Employees

- Brewer role – 7.5%

- Non-production, non-service role – 37%

- Brewery service role – 54%

- Other – 1.5%

In our conversation, Bart provided additional context: “We’ve done a variety of benchmarking and data gathering in this area in recent years – both internal to brewery employees and owners and external to customers.”

On Customers

“We’ve seen that the customers and the industry skew heavily white and male. I think we’ve seen some signs of progress on the customer side in terms of gender balance. More women are coming into the category. And you see this particularly in some of the real craft beer hot spots like Denver, Portland and San Diego. But a little bit less so on racial terms…. So there hasn’t been a lot progress in the area of diversifying the craft beer base. That’s a challenge and an opportunity for craft brewers to introduce more people to the craft beer party and the wonderful beers they brew.”

On Industry

“We’ve only done one benchmarking of this area but it showed many similar things in that owners are pretty heavily white and male as are many parts of employees. Although that’s less true as you move into service employees. And that provides us a benchmark to see where the industry is the next time we conduct that survey which hopefully will be next year.”

Using Beer by the Numbers to Help Move Forward

“So we’re gathering a lot of data here. I think that data is a key point in understanding where the industry is so that we can measure progress. The Brewers Association diversity committee is helping lead some of the actions that we’re trying to do to help our members have more diverse businesses. And in turn, I think these businesses will be more successful and try to help diversify the customer base, which we think will also grow the craft beer market.”

A big THANK YOU to Bart Watson for the interview and discussing beer by the numbers.